L'invite

21 May 2023Ayesha Ofori, Founder of Propelle

This week we’ve been chatting with Ayesha Ofori, Founder of Propelle.

Tell us a little bit about your background

I was born and grew up in North West London - I'm a Londoner through and through. I went to school in London, University in London, and got my first and subsequent jobs in London. I'm a physicist at heart, but a very social one. So I don't fit the cliché stereotype. I love math/ numbers and I find building Excel models very satisfying. Lol. I'm also a mum to two very confident little girls and I'm a wife. I'm an ex-banker and spent around 10 years in Banking altogether, starting at Morgan Stanley and finishing my banking career at Goldman Sachs where I was an ultra-high net wealth adviser - i.e. I managed and invested the money of the UK's richest people. I spent 2 years at London Business School getting my MBA (and spending some of that time in New York finishing my MBA at Columbia Business School) before going to Goldman.

Today, I am the founder and CEO of Propelle, a Fintech platform designed specifically for women, to help them invest regularly and build wealth. The investment industry doesn't engage with women in the way it should and many of us hold cash or "invest" just in ISAs. Built on 3 pillars of community, financial education and investment, Propelle is changing the investment landscape for women. Propelle is where women build wealth.

Where did the idea for Propelle come from?

When I was at Goldman Sachs, most of my clients were men. Actually, most of the clients of my division were men. I'd often think "Where are the women? Why don't women have any money? If they do why aren't they investing it?".

Also, it was ironic that although I was investing literally hundreds of millions of pounds on behalf of my clients I was doing pretty much nothing with my own money... until I found property investing. When I "found" property investing, I jumped in, taught myself everything there was to know and started to invest... rapidly. I built up a decent-sized property portfolio that gave me financial freedom (which is ironic as people assume I made money from being a "rich" banker... not at all!). I loved investing in property, loved that I could do it whilst working full-time, and loved that I could literally go and see and touch where my money was going. Then I had an idea...if I love it this much, maybe other women will too. So I did some research and started to help women invest in property, from as little as £100 (through fractionalised property investing).

I realised that not everyone was as fortunate as I was in having a lump sum to get started with and I wanted to help ALL women, regardless of how much or little they had. It was going amazingly well and many of the women started to ask for help investing in other things in addition to property. They'd say "You've helped me invest the property pot of my money, can I open an ISA with you? Can you point me in the right direction regarding my pension". They were asking for a multi-asset class service which was literally what I'd been doing at Goldman Sachs for years (just for the uber-wealthy)... that was my lightbulb moment. If women were asking for a platform to be able to invest in much more than just property, why not build one for them? So I did... and that's the beginning of the Propelle we have today. Propelle is where women build wealth.. their way!

You worked at one of the world’s largest investment companies, Goldman Sachs, what made you leave to start your own business?

I wanted to do something that would allow me to have a purpose in my life and also help me work toward creating a lasting legacy. At some point, I lost that at Goldman. I got to a point in my life where I started to think about being old and grey and how I wanted to be remembered and what impact I wanted to have on the world. It dawned on me that helping just the uber-wealthy to get even richer didn't align with my values or the impact I wanted to have. I wanted to help the majority, not just the 1%. So I left Goldman Sachs (which wasn't easy) to do this and specifically to help women build wealth.

What is a shocking fact about women and finance people should really know?

A positive, but shocking one... by 2025, 60% of UK wealth will be controlled by women. This is great! But it does mean women are going to need to be savvy about where and how to invest this wealth if we want to keep hold of it and grow it!

What would be your advice for women looking to invest for the very first time?

Well, aside from joining Propelle... just start. Even if you invest a very small amount and you're not fully comfortable or confident. Starting has a big psychologic impact and means you've put a marker in the sand and you're more likely to do more. When it comes to doing more, the first step would be to create an investment plan and then follow that. How do you create an investment plan? Well, the team and I at Propelle can help... we've created amazing tools and resources that allow you to do just this.

Did you always know you wanted to be an entrepreneur?

Not until I went to Business School. Pre Business School my "dream" was to be a Partner at Goldman Sachs (don't judge me... all I'd ever known at that point was banking). Then I went to Business School and it opened my eyes to the almost endless possibilities of what's out there in the world and what I could achieve. It showed me that it was possible for me to attain almost anything if I wanted it and was prepared to work for it. I had a few friends who started companies while at business school - some very successfully, others not so much. But it was a combination of all of this that made me realise I wanted to build something of my own one day. Something that would positively impact the world and enable me to leave a lasting legacy.

How do you find balancing your home life and work life with a start-up brand?

Life is very busy. Pretty much every moment of my day, evening and part of the night is assigned to something. I've even had to start adding lunch to my calendar as there were days I found I forgot to eat - which is terrible. Most of the time, with a lot of pre-planning, I can get things to work but it does mean having to rely on a group of people to help. I have a full-time nanny for my children, a cleaner, a husband and grandparents who can step in when needed. But sometimes even with all that support it doesn't work. In those situations, I do the best I can and try not to beat myself up about it when things don't run quite so smoothly.

How did you find raising investment for your business? Any tips for budding entrepreneurs?

I won't sugarcoat it... fundraising is hard. Especially if you're a woman and even more so if you're a woman of colour. That said, it's still possible but you have to be ready. You have to embrace the challenge and be relentless. I wrote about this on my LinkedIn page recently, the top 5 tips I gave about fundraising were:

Have a process. Keep it tight, short and stick to it. You don't want to be "in the market" for too long.

Start engaging with could-be investors several months before you actually start the fundraise.

Don't waste time on investors who don't typically invest in your business area or those who are just kicking the tyres.

When it looks like an investor is wasting your time, walk away. Your time is precious!

Accept it's going to be painful. Focus on sticking to your process and making it to the other side.

You really champion women specifically when it comes to money matters. Where did this passion come from?

I identify as a black woman, so being black and my heritage is very important to me, as is being a woman. When I decided to leave my corporate career behind to focus on something that aligned with my values and gave me purpose, it was natural that championing women was going to feature. Also in the financial investment industry which is where my professional experience comes from, women weren't really top of mind when it came to servicing the needs of customers and I found this really frustrating. My nature is such that if I see something is broken... I will try to fix it. If it's hard to fix then that makes me even more determined because I love challenges and if there's some element of inequality then I'm like a dog with a bone. I cannot stand inequality.

How have you found managing a team and any tips for managers?

Managing a team for me is a constantly evolving journey. I've learnt and continue to learn a lot about myself and my ability to listen and empathise with others. Sometimes it's challenging balancing the needs, feelings and emotions of team members with the needs of the business, particularly across generations (eg Gen Z vs Millennials) but overall it's been fun. Having a great team who believe in the Propelle mission as much as I do is so important and I'm lucky to have that.

3 do’s and don’t of managing your own finances?

1. Have a strategy and work on following it. It's easy to get distracted by life so you don't invest regularly or you spend more than you planned somewhere so then you have less to invest. If you have a well thought out strategy that matches your life circumstances it should be relatively easy to stick to.

2. Don't do it alone (at least you don't have to). There are so many places you can go for various kinds of support and guidance. Propelle is a prime example.

3. Start as soon as you can. Even if it means you can only invest a small about regularly. The power of investing comes from compounding which means you get more benefits the longer you're invested even if with small amounts of money.

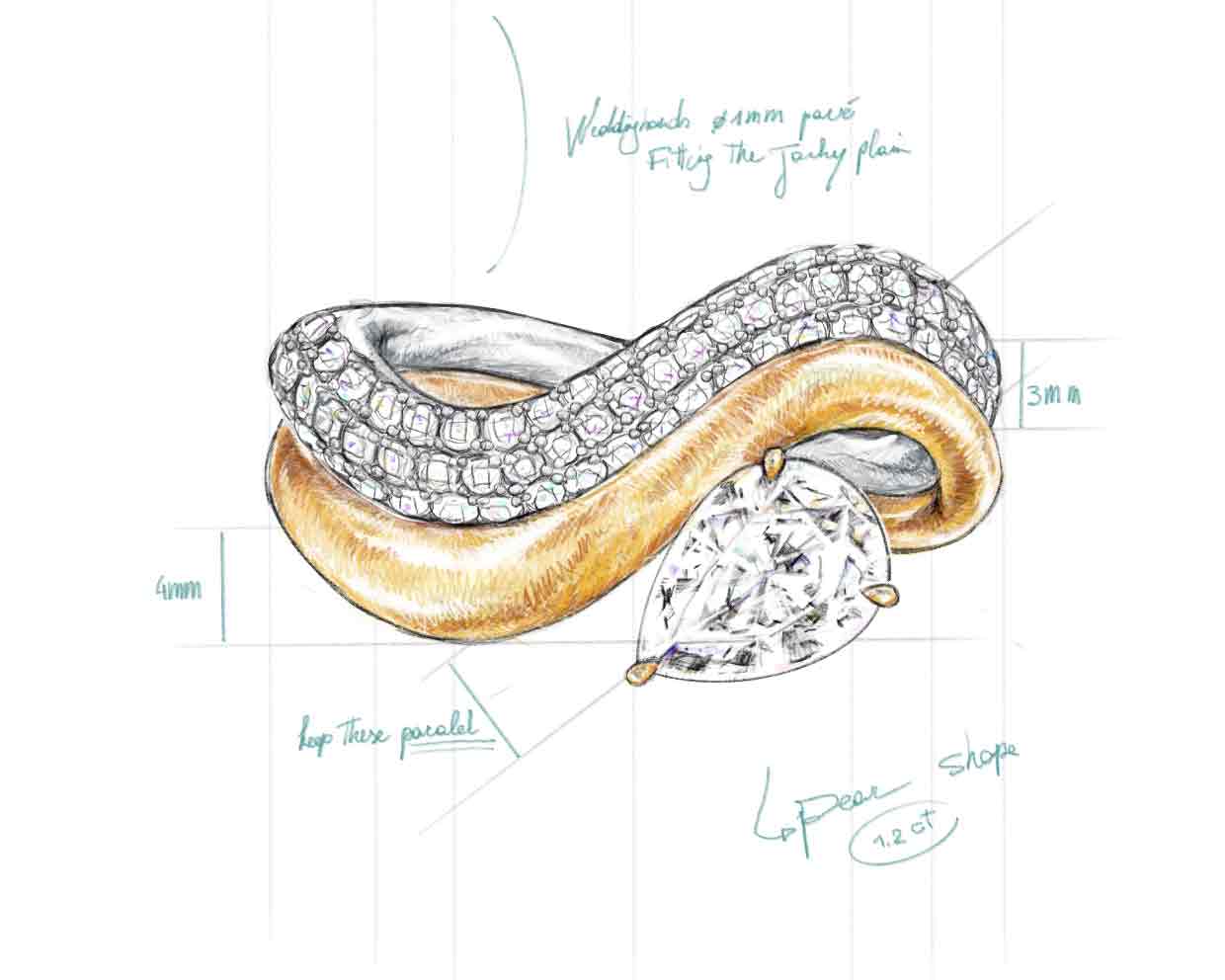

Do you have a piece of jewellery that is particularly special to you?

My engagement ring. My husband designed it himself and the layout, number of stones and carat of the main stone represent the digits from my year of birth. He put a lot of thought into it!

Thank you so much for chatting with us Ayesha. If you want to learn more about the work she is doing at Propelle you can follow her here